The Indian real estate market is thriving again in 2025. Driven by infrastructure projects, increased end-user interest, and government reforms, housing prices in top cities are expected to rise by 6.5% this year. Some areas are growing faster than others, becoming real estate hotspots. These emerging micro-markets offer a mix of affordability, strong rental income, and long-term appreciation. The complete list of emerging real estate markets in India in 2025 includes:

Delhi-NCR

- Noida Extension (Greater Noida West)

- Dwarka Expressway (Sectors 99–112, Gurugram)

Mumbai Metropolitan Region (MMR)

- Kharghar (Navi Mumbai)

- Panvel (including Ulwe & Pushpak Nagar)

Bengaluru

- Hebbal

- Thanisandra Main Road

- Yelahanka

- Bagalur & Hennur Road

- Devanahalli

Pune

- Wakad

- Tathawade

- Mahalunge

- Baner Annexe

Kolkata

- New Town (Action Areas I, II, III)

- Rajarhat (including Hatiara, Rekjuani)

Ahmedabad-Gandhinagar

- GIFT City

- Raysan, Koba, Sargasan Circle (peripheral GIFT zones)

Hyderabad

- Madhapur (HITEC City area, Kavuri Hills)

- Kondapur (Whitefields, Hafeezpet)

Chennai

- Sholinganallur

- Perumbakkam

- Nookampalayam Road & Medavakkam (influencing zones)

India’s Top 10 High-Potential Markets for 2025

Out of 22 micro-markets, here we will discuss top 10 micro-markets that are emerging fast in the landscape of real estate.

1. Noida Extension (Greater Noida West)

Once affordable, Noida Extension is now entering the mid-income segment with rising prices and demand. The upcoming Jewar Airport and new metro lines will boost its future value. Sectors like Techzone IV and Sector 1 are growing fast. Godrej Majesty, Ace Hanei, and Eros Sampoornam are some prime projects being developed in this micro-market.

- Avg Price: ₹7,500/sq ft

- Rental Yield: ~3%

- Growth Trigger: Jewar Airport, Metro Extension

Ideal for: First-time buyers, middle-income families, and long-term investors

2. Kharghar-Panvel (Navi Mumbai)

The upcoming airport and sea bridge are turning this corridor into a booming residential zone. Kharghar suits families with its social infra, while Panvel attracts investors seeking appreciation.

- Avg Price: ₹9,500/sq ft (Kharghar), ₹8,300/sq ft (Panvel)

- Rental Yield: ~3%

- Growth Trigger: Navi Mumbai Airport, Mumbai Trans Harbour Link (MTHL)

Ideal for: Mumbai upgraders, NRI investors, and working professionals

3. North Bengaluru (Hebbal, Yelahanka, Thanisandra)

North Bengaluru is becoming the next big IT and aerospace hub. With better infrastructure and more space than saturated east and south Bengaluru, it’s drawing investors and NRIs.

- Avg Price: ₹10,000/sq ft

- Rental Yield: 4.5%+

- Growth Trigger: Peripheral Ring Road, and Airport Metro Line

Ideal for: IT professionals, NRIs, and rental income seekers

4. Wakad-Tathawade (Pune)

Located near Pune’s largest IT park, these areas offer ready-to-move flats and excellent rental returns. Tathawade still provides relatively affordable options.

- Avg Price: ₹8,500/sq ft

- Rental Yield: ~3%

- Growth Trigger: Pune Metro Line 3, Hinjewadi proximity

Ideal for: Tech employees and investors from Mumbai

5. Rajarhat-New Town (Kolkata)

Kolkata’s most planned urban zone is growing steadily. With new offices, better roads, and parks, this area is appealing for both end-users and NRIs from Bengal.

- Avg Price: ₹7,100/sq ft

- Rental Yield: ~3%

- Growth Trigger: Metro Line 6, Smart City infrastructure

Ideal for: Young families, returnees to Kolkata, and smart city believers

6. GIFT City (Gujarat)

India’s first smart financial city is attracting banks, fintech firms, and NRIs. While housing supply is still growing, the long-term outlook is promising.

- Avg Price: ₹11,000/sq ft

- Rental Yield: 5%+

- Growth Trigger: IFSC, Smart City, Metro & Bullet Train access

Ideal for: Finance professionals, institutional investors, and NRIs from Gujarat

7. Mahalunge-Baner Annexe (Pune)

This area links upscale Baner with Hinjewadi and is emerging with mega townships and improved roads. It’s popular with IT employees.

- Avg Price: ₹8,300/sq ft

- Rental Yield: ~3%

- Growth Trigger: Hi-Tech City development, new bridges, townships

Ideal for: Young buyers, township lifestyle seekers, and Pune locals

8. Madhapur-Kondapur (Hyderabad)

Hyderabad’s IT belt continues to grow. These locations are central, well-connected, and in high demand for rentals.

- Avg Price: ₹9,500–₹12,000/sq ft

- Rental Yield: ~3.5%

- Growth Trigger: IT expansions, Metro Phase 2, Image Towers

Ideal for: Senior IT staff, investors targeting NRIs, and end-users upgrading from rented flats

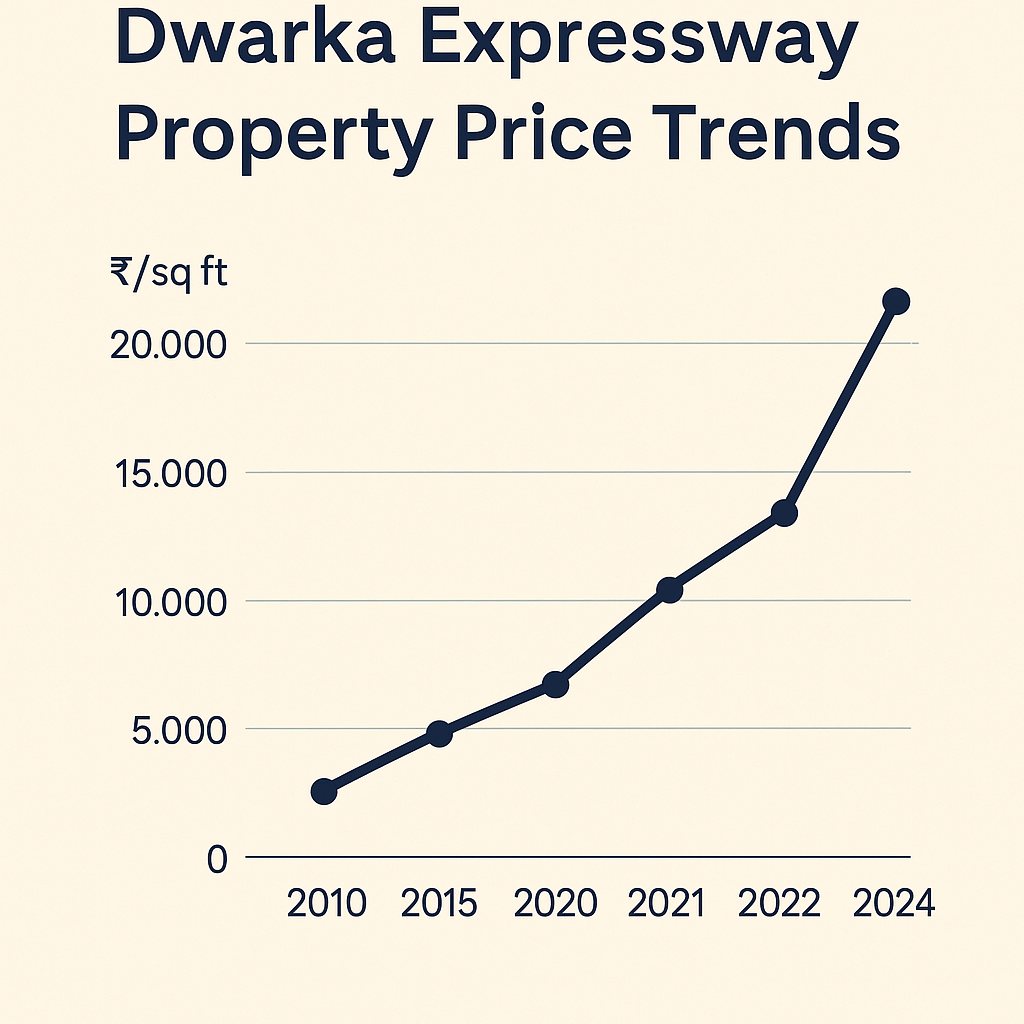

9. Dwarka Expressway (Gurugram)

This fast-rising zone connects Delhi and Gurugram. Property values surged by ~29% in 2024. Now drawing both end-users and NRIs, especially those shifting from Delhi. Godrej Vrikshya (Sector 103), M3M Mansion/Crown (Sectors 111 & 113), and Sobha Altus (Sector 106) are some popular residential projects being developed around Dwarka Expressway.

- Avg Price: ₹10,000+/sq ft

- Rental Yield: ~2.5%

- Growth Trigger: Expressway completion, Metro proposal, Diplomatic Enclave

Ideal for: Delhi upgraders, NRI investors, and long-term planners

10. Sholinganallur-Perumbakkam (Chennai)

Close to IT parks, these areas offer affordable modern housing with better air and amenities. As metro lines expand, these locations will be more connected.

- Avg Price: ₹7,800/sq ft (Sholinganallur), ₹6,000/sq ft (Perumbakkam)

- Rental Yield: ~3%

- Growth Trigger: Metro Phase 2, OMR Elevated Expressway

Ideal for: IT families, affordable buyers, and those relocating within South Chennai

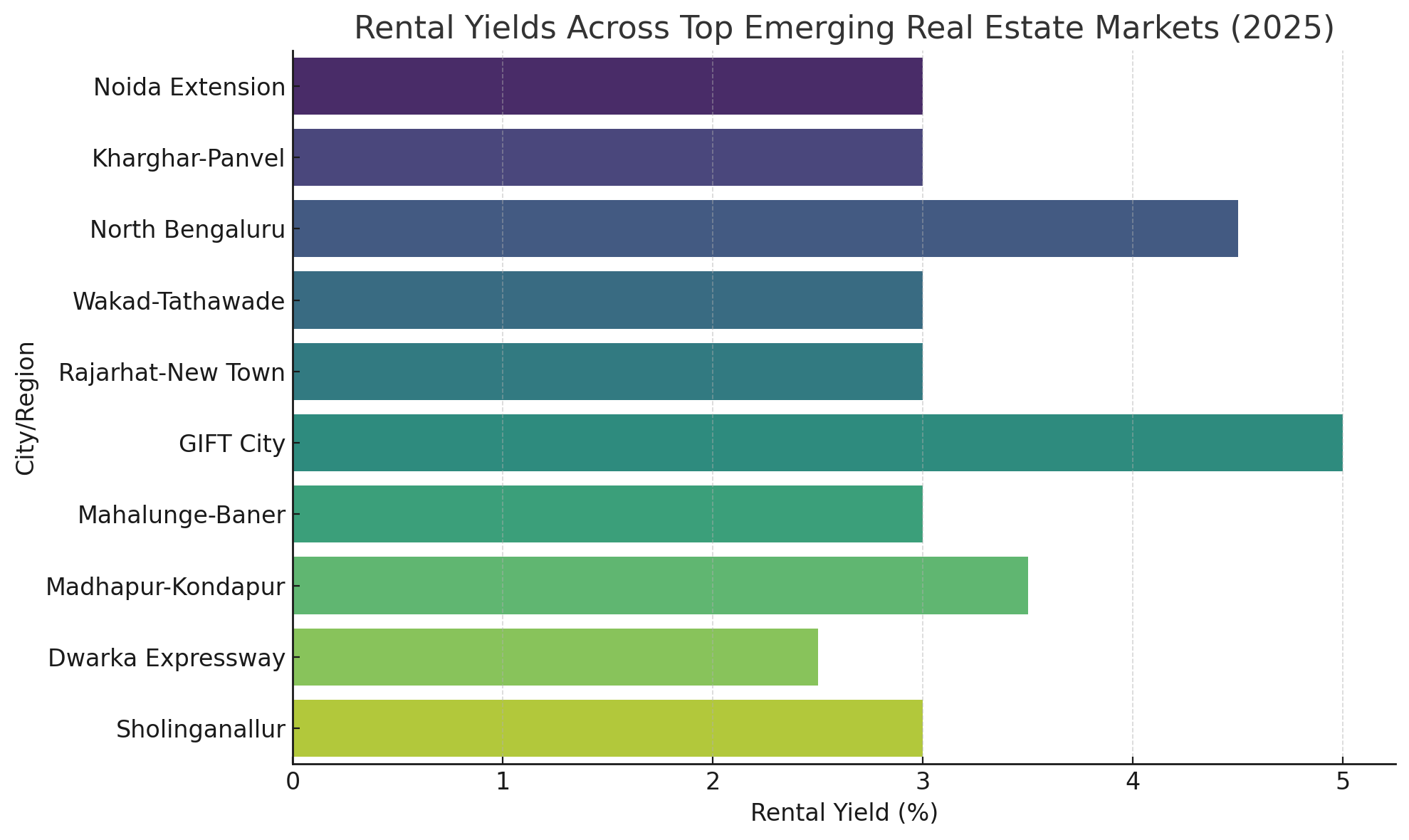

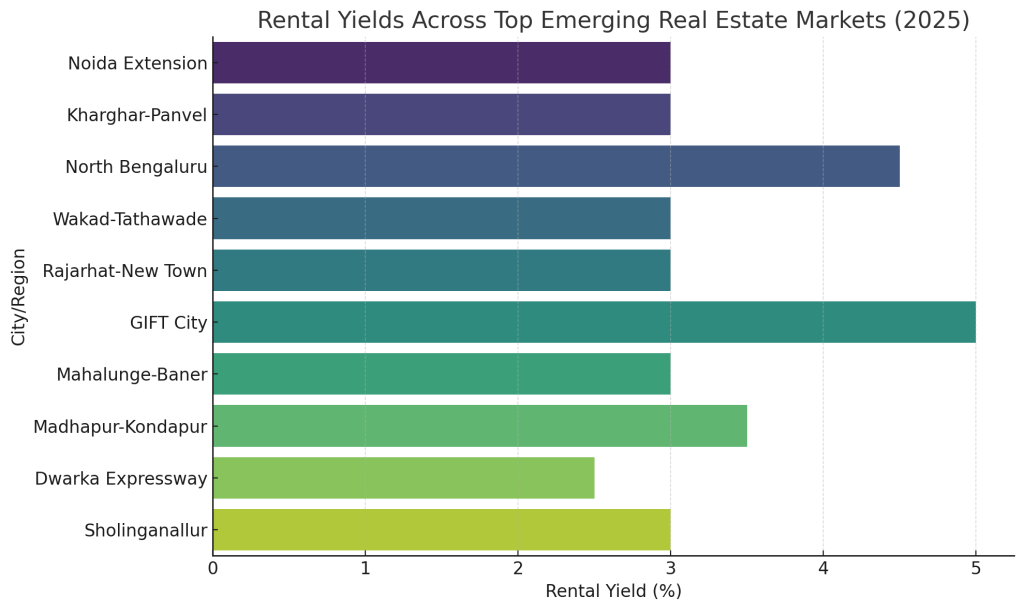

| City/Region | Avg Price (₹/sq ft) | Rental Yield (%) | YoY Price Growth (%) |

| Noida Extension | 7500 | 3 | 25 |

| Kharghar-Panvel | 9500 | 3 | 20 |

| North Bengaluru | 10000 | 4.5 | 30 |

| Wakad-Tathawade | 8500 | 3 | 15 |

| Rajarhat-New Town | 7100 | 3 | 10 |

| GIFT City | 11000 | 5 | 26 |

| Mahalunge-Baner | 8300 | 3 | 5 |

| Madhapur-Kondapur | 9500 | 3.5 | 8 |

| Dwarka Expressway | 10000 | 2.5 | 29 |

| Sholinganallur | 7800 | 3 | 11 |

2023 Emerging Real Estate Market Summary

Key Trends Shaping India’s Emerging Markets

- Affordable-to-Premium Shift: Many emerging markets now have luxury homes too.

- Infra Drives Growth: Metro lines, airports, and expressways are major price drivers.

- Investor-to-End-User Shift: Initially investor-led areas are now seeing end-user demand.

- Rental Yields Rising: Especially in IT and finance hubs (e.g., GIFT City, North Bengaluru).

- Township Demand: Buyers prefer integrated projects with clubs, parks, and retail.

Final Tips for Buyers & Investors

- Compare rental income vs. cost (aim for 3%+ yield)

- Don’t rely only on future infra promises – check timelines

- Hold for 5+ years for best results

- Pick RERA-registered builders with a strong track record

- Visit the area, check daily conveniences

Conclusion

India’s top emerging real estate markets are no longer just “upcoming zones” – they’re vibrant housing destinations in the making. With the right location, timing, and builder, you can secure a property that not only appreciates in value but also improves your quality of life.

For 2025 and beyond, investing in the right micro-market could be your smartest move yet.

Ref:

Economic Times, ET Wealth, ET Real Estate, Hindustan Times, Housing.com, 99acres.com, MagicBricks.com, NoBroker.in, Global Property Guide, and Anarock Reports