CERSAI (Central Registry of Securitization Asset Reconstruction and Security Interest of India) is a government-backed online registry that helps buyers, banks, and financial institutions check whether a property—movable, immovable, or intangible—has already been mortgaged or used as loan collateral. The prime purpose of CERSAI is to record all property-related loans to prevent fraud. CERSAI Property Search clearly helps property buyers verify if the property they are planning to buy is already mortgaged before purchase.

Why is CERSAI Important for Real Estate in India?

CERSAI helps protect homebuyers from fraud. In many cases, sellers may hide that a property is already mortgaged or used as security for a loan. If you unknowingly buy such a property, the bank can claim it, leaving you in serious legal trouble.

CERSAI provides transparency about the financial status of properties—this is critical in cities like Delhi NCR, where property frauds are more common due to high demand.

Benefits of CERSAI Property Search for Property Buyers

Check for Previous Loans: Know whether a flat, land, or building has any existing charge (loan/mortgage) on it.

Avoid Double Mortgage Fraud: It prevents a seller from mortgaging a property to multiple banks or selling it illegally.

Peace of Mind Before Investment: Reduces legal and financial risks before you invest your savings into real estate.

Quick Online Search: Anyone can search property records online via the CERSAI portal using asset details.

Supports Due Diligence: It complements legal property verification (like title search, encumbrance certificate, etc.).

CERSAI Relevant Laws & Regulations

CERSAI was established under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002. In 2011, the Ministry of Finance made it mandatory.

It is said that all banks and Non-Banking Financial Companies (NBFCs) must register mortgages and secured loans on CERSAI. According to Rule 4(2) of the Security Interest Rules, 2007, the charge must be registered within 30 days of creation.

How CERSAI Works (Step-by-Step for Property Buyers)?

- First of all, visit the official portal: Go to https://www.cersai.org.in.

- Register as a public user.

- Choose type of search: You can search by debtor name and asset details.

- Enter exact asset/property details.

- Review the search results: If there is a charge/mortgage listed, it will show details of the loan and financial institution.

- Download the report as a PDF for your records or verification.

How Credible and Useful is CERSAI in India?

Credible: CERSAI is a central government initiative under the Ministry of Finance. All major banks, housing finance companies, and NBFCs are legally bound to report asset-backed loans here.

Useful: In Delhi NCR, where real estate scams involving double sales and hidden mortgages are common, CERSAI is a crucial due diligence step. However, it does not replace

- Checking land title,

- Builder’s credibility, and

- RERA registration status.

Limitations to Keep in Mind

CERSAI lists only registered loans. If a mortgage or private agreement isn’t registered, it won’t show up. Some old or unregistered properties may not appear. Not all states fully link immovable property with CERSAI yet (progressive integration is ongoing). Before you buy a flat in Delhi NCR:

- Always check the CERSAI registry.

- Verify RERA ID at https://rera.delhi.gov.in/.

- Get an encumbrance certificate from the Sub-Registrar Office.

- Hire a property lawyer for due diligence.

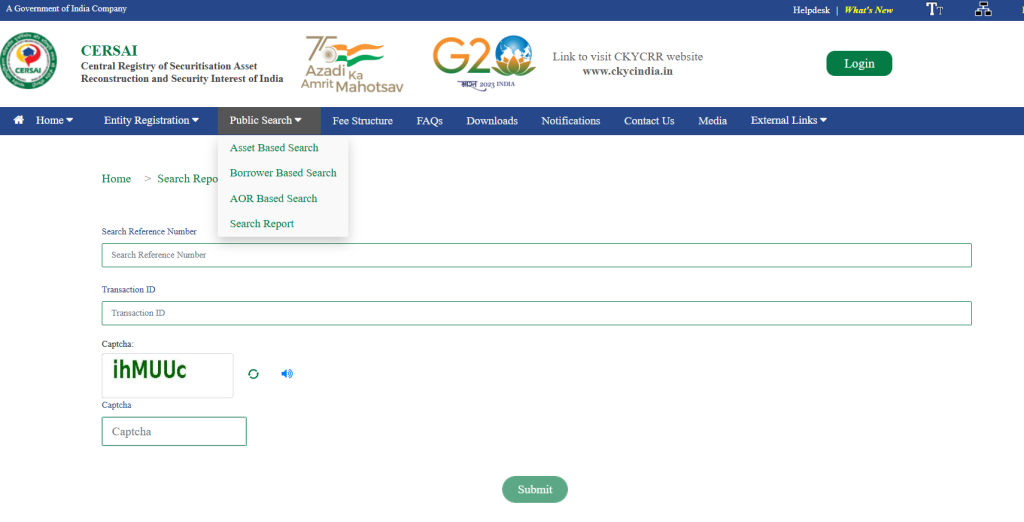

How to Take CERSAI Search Reports (Step-by-Step)?

To get a CERSAI search report, follow this simple process:

Step 1: Visit the Official Website: Go to the CERSAI portal.

Step 2: Register as a Public User

- Click on “Public Search.”

- Click on “Register as a New Public User.”

- Fill in your name, email ID, mobile number, PAN (optional), and address.

- Create a username/password and submit.

After approval, you’ll get login credentials by email.

Step 3: Login and Start Search

Log in to your account from the Public Search option.

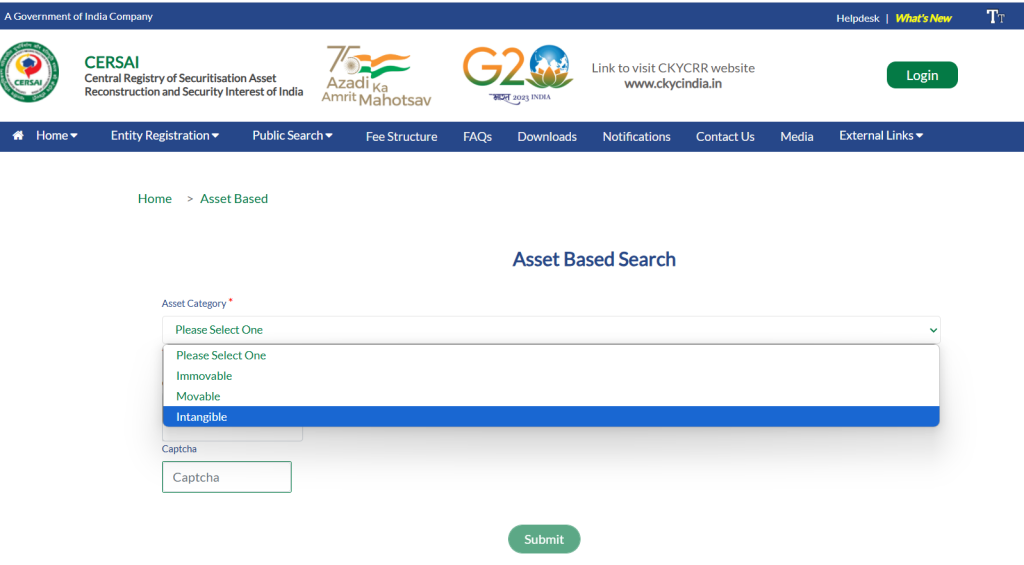

Choose one of the following search criteria:

- By Debtor Name (for individuals or companies)

- By Asset Details (flat number, vehicle number, etc.)

Step 4: Make Payment

- You must pay a small fee online: ₹10 for individual searches and ₹50 for searches by asset details.

- Payment is done via UPI, debit card, or net banking.

Step 5: View & Download the Report

- Once payment is successful, the system shows the search results.

- If any security interest is registered, it shows the lender name, date of registration, asset involved, and type of charge (loan, hypothecation, etc.).

- Click “Download Report” or save as PDF for legal record.

Conclusion: How Useful is the CERSAI Report?

| Factor | Verdict |

| Credibility | Govt-backed |

| Ease of Use | Online and low-cost |

| Coverage | Most major lenders and cities |

| Limitations | May not cover unregistered charges or private deals. |

| Risk Protection | Very high, especially in metro real estate |

Sample Use Case:

Suppose you’re buying Flat XXXX, Noida Sector 137. Use asset-based search to check if any bank or NBFC has a charge on it. If the report is clean (no charge), you’re safer. If a charge exists, do not proceed until it’s cleared and removed from the registry.

According to a source of the Ministry of Finance Statement, 2023—via PIB India—over 45 crore records (movable and immovable assets) are registered with CERSAI as of 2024. RBI and SEBI both endorse CERSAI as a key tool in India’s Digital Public Infrastructure for asset security. CERSAI has helped banks identify multiple fraud cases where one property was mortgaged to several banks.

In 2017, CERSAI data helped uncover a ₹1,100 crore fraud in Delhi, where developers mortgaged the same assets multiple times to different lenders.